I’ve been thinking about vacant housing units in San Diego for some time and recently was reading about the issue in Vancouver, Canada. The data provided was much more thorough than anything I found locally so I wanted to use it to estimate what the numbers might be in San Diego. Following is my take and links to the underlying information from Vancouver. If you have information on this topic I’d love to connect or hear your input.

This article from the Vancouver Sun from February 2017 lays out some good information about vacant housing units in that city, which in recent years has been often in the news for quickly rising housing prices. Included is the following:

- The figures from “2016 show there were 25,502 unoccupied or empty housing units in the City of Vancouver” (below graph from article shows the growth in this number from 1986 to 2016, a period during which Vancouver real estate prices skyrocketed)

- This figure is for the City of Vancouver, not the region, and represents 8.2 per cent of total housing units

- Per City of Vancouver, there were 309,418 total dwelling units in the municipality as of 2016. This total supports the above calculations (309,418 x 8.2% yields 25,372 or roughly the same amount as show in bullet one)

In response to the high housing prices in Vancouver, the city levied a 1% property tax surcharge on vacant units to push owners to add the units to the housing supply for renters or other owners.

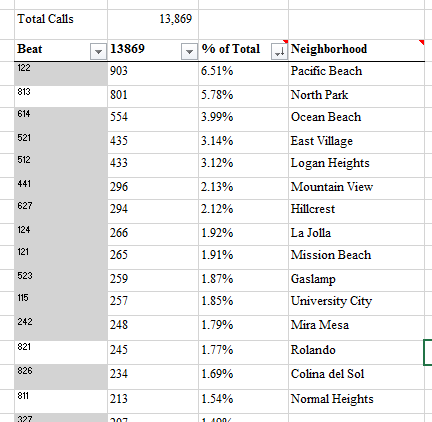

I’ve been trying to find vacant number estimates or similar studies in San Diego and have asked various reporters, housing industry experts, random Twitter users, and other avenues to seek this information. The answers I have received have been all anecdotal but mostly consistent – there are a lot of Downtown condos and probably a fair share of other units that are mostly vacant but it’s hard to ballpark the percentage.

Vancouver is a relatively similar city to San Diego, located on the west coast of North America and with high housing prices and demand. Below are some basic demographic and economic factors – San Diego is larger but in the same ballpark, a large regional hub in a developed country.

- Media income – Vancouver metro = $53,759 (2016 median family income converted to US dollars), San Diego metro (2015 median household income) = $64,309

- Poplulation (metro) – Vancouver = 2.3M, San Diego = 3.3M

- Poplation (city) – Vancouver = 647,520, San Diego = 1.4M

- Housing units (city) – Vancouver = 309,418, San Diego = 526,663 (1/1/2015)

Since I can’t find a good local estimate for vacant units I thought Vancouver would be a reasonable estimate, or at least a starting point for conversation and hopefully the SD City Council, EDC, Chamber of Commerce, or other party could commission a study to quantify this aspect of housing stock in San Diego. (I would guess the amount would be higher in San Diego than Vancouver given the long history as a vacation destination, the warmer weather, and the presence of large population centers nearby – Los Angeles, Phoenix, Las Vegas, etc.)

The above San Diego housing unit number from SANDAG estimates the number of vacant units in San Diego at 27,386 (based on provided vacancy rate of 5.2%)

The SANDAG numbers may best reflect the number of vacant units, but it’s worth looking at a portion of the above referenced Vancouver Sun article which notes that the private study produced a vacancy rate more than double existing city estimates.

“The census numbers of unoccupied units are more than double an estimate released by city hall last year because a completely different set of criteria and data were used.

Assessing the extent of empty or underused homes can differ depending on “your measurement tools,” said Yan.

While the census might count a greater number of folks who are, say, on extended vacation during the census period, the city’s estimate was criticized for likely missing the number of units used for only short, seasonal periods, perhaps one or two months in the summer, but then are left vacant for the rest of the year.”

So, based on SANDAG’s vacancy rate of 5.2% we would have 27,386 vacant units in San Diego. Using the Vancouver vacancy rate of 8.2% would estimate 43,186 vacant units here. And if we thought that the government estimates are off by half due to sampling methodology, as they were in Vancouver, we could use a rate of 10.4%, yielding 54,773 vacant units in San Diego.

Given the large impact that property tax rules in California can have on homes held for long periods (Prop 13 being most prominent) I would think the vacancy number in San Diego would be at the high end of the above numbers, probably 50,000 or higher, maybe much higher. Prop 13, over time, can result in incredibly low property tax burdens for long-time owners. Prop 13 allows properties like the amazing home below, currently for sale for $1.7M, to pay a total of $136.97 in total taxes a year – a rate of .008% rather than the approx 1.05%, $17,850 a year, if taxes were applied on market value at existing property tax rates. When holding costs are essentially nothing, there’s greatly decreased incentive to sell and little cost to holding an empty property. It’s probably a large part of the reason the house across the street from me in desirable North Park, which is worth around $750k, has sat completely empty for the 4 years I’ve been in the neighborhood.

I’m not advocating for an empty house tax as Vancouver did, but seeking to get an estimate of vacant units in San Diego to consider a similar or other action. Being involved in the short-term rental (aka Airbnb) debate here the impact of short-term rentals on housing availability and prices frequently comes up. It’s undeniable that increased demand has an upward effect on housing prices. However, short-term rentals produce economic activity for owners, businesses, and the city whereas empty units do none of those things. Upper estimates of short-term rental units in San Diego are around 15,000 (I would guess it’s around half that number) – likely far dwarfed by empty units in our city. We would be much better served putting vacant units on the market rather than reducing economic activity, entrepreneurial opportunity, and property rights by greatly restricting short-term rentals.

![Austin is a really cool town and they have houses there! [Zillow screenshot]](https://i0.wp.com/www.johnpatrickanderson.com/wp-content/uploads/2015/10/zillow-snip-1024x453.png?resize=660%2C292&ssl=1)